- Hold Your Horses

- A Big Fish in a Small Pond

- Bitcoin Market Sentiment: A Valuable Tool in Your Arsenal

There’s a rather unhealthy obsession going on with price in the Bitcoin market. Speculators are everywhere, particularly on social media where a few good calls can grow your audience exponentially, just like the price itself. A new wave of crypto projects and research outfits are popping up with buzzwords like artificial intelligence and bold claims around predictive algorithms that will supposedly lead to untold riches.

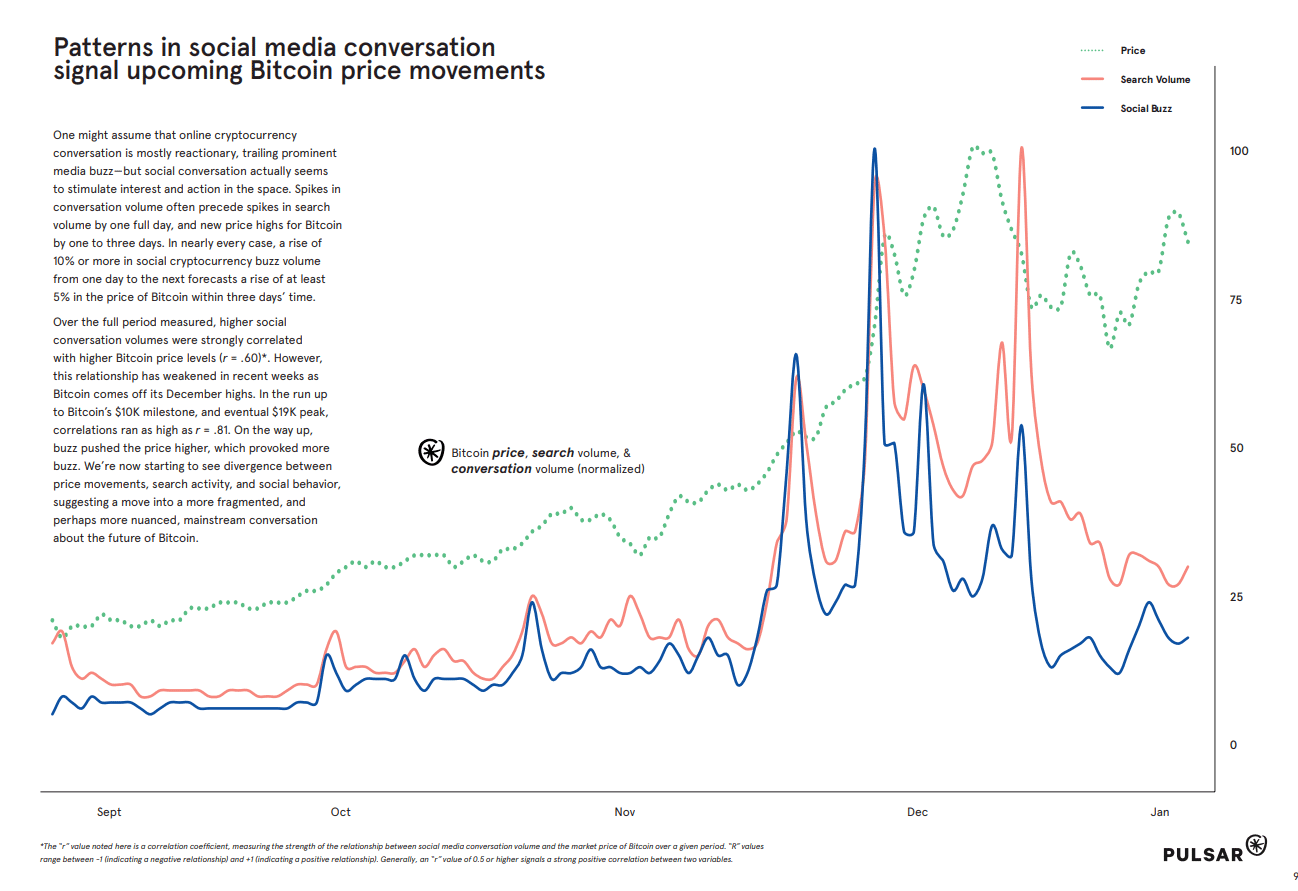

The new kid on the block appears to be social sentiment analysis. Are everyday people actually talking about cryptocurrency? A recent study by the social listening platform Pulsar decided to find out exactly that. The company explored close to five million discussions across social media specifically related to Bitcoin. Some of the key takeaways from the report included things like:

- Bitcoin maintains its spot as the cryptocurrency brand name

- Despite rapid price growth most people still don’t understand what crypto is

- Cryptocurrency’s killer app still remains a frictionless money transfer system

- A reduction in the shady image of crypto

The study goes on to claim that for every 10 percent of social buzz volume registered there was somewhere in the region of a 5 percent rise in the price of Bitcoin within three days.

The results are remarkable and highlight a strategy that may have netted you a healthy return in recent years. Can social buzz be a leading indicator when it comes to price movements in the cryptocurrency markets?

Hold Your Horses

Now before you go rushing off to make your crypto millions with your newfound knowledge, you may want to get some perspective. This particular study was conducted between September 2017 and January 2018. Experienced crypto fans will point out that there’s almost practically no way you could’ve lost money in 2017. The price curve of Bitcoin and almost every other altcoin was parabolic.

A study done over the last few months of a speculative mania is probably not the most reliable indicator for the long term – an issue highlighted by Pulsar themselves. Regardless, the insights gained are certainly food for thought. Social sentiment definitely plays a role. How much of a role is the bigger question. A more thorough study that covers both the bull and bear cases in Bitcoin over a longer period should give traders and investors alike greater confidence in the future.

An Alternative Approach

An alternative and longer-reaching approach conducted by Professor Feng Mai at the Stevens School of Business gives some additional insights. Mai, working with a team from several universities, collected two years’ worth of data from Bitcointalk and two months’ worth of data from Twitter. Bitcointalk is the famed forum that saw anonymous creator Satoshi Nakamoto discuss and debate his/her/their solution to a new form of digital money that would ultimately become the cryptocurrency king we know and love today.

The research team programmed a script to collect comment data and sort it into positive, negative, and other sentiment categories. Using a statistical method known as vector error correction, or VECM, they then compared the price of Bitcoin with the cryptocurrency buzz generated by the two social media platforms. The four-strong university project also accounted for other traditional economic markets like shares, gold, and volatility indices to provide a more balanced picture of events. Mai further noted that:

“It’s not a one-way relationship, any changes in Bitcoin’s price are obviously going to affect the sentiment around it, so we needed to factor in those influences as well.”

The study concluded that social media influence does, in fact, affect the price of Bitcoin significantly. No doubt, some members of the cryptocurrency community will argue that the outcome was obvious. That said, probably no other statistical study has been carried out at such a high level and further validates what savvy investors have been thinking all along. If you’d like to dig into the details you can access the study at the Journal of Management Information Systems, though it will set you back $43.

A Big Fish in a Small Pond

At this point, it’s worth playing devil’s advocate and looking at the contrarian point of view. To date, crypto has largely been a retail investor phenomenon. Social sentiment generally plays a bigger role when there are only small fish in the pond. What happens when the big fish show up? Take for example the latest buzz around institutional money flowing into the crypto space. If the rumors are true then social sentiment may not be as relevant when the flows start to happen.

What moves markets is capital. And lots of it. If ten of your followers buy $1000 worth of Bitcoin, but an institution puts in an order for $10 million, no prizes for guessing who’s actually going to move the market. Institutional investors are already using OTC to enter the Bitcoin market. Unless wealthy investors are actually tweeting their trades, no amount of social media research will actually give you any clues on price trends.

That does, of course, mean in theory that social sentiment indicators could be more accurate for altcoins with decent liquidity. Don’t be fooled by pump-and-dump groups, though. There’s a reason why scams are harder to pull off with highly capitalized cryptocurrencies like Bitcoin.

Bitcoin Market Sentiment: A Valuable Tool in Your Arsenal

Sentiment has played a role in traditional markets for ages. The game has changed however and is constantly evolving with the influx of new channels. Social media is generally the playground of the youth. Reddit, Snapchat, Twitter, Facebook, Telegram, the list almost never ends. It’s no wonder that ICO projects look to raise their exposure through every channel that’s available. It’s still no magic bullet, however, and other disciplines like fundamental and technical analysis still play a key role when assessing the Bitcoin market.

Pundits and researchers everywhere will continue to stake the holy grail of all claims – market prediction. Unfortunately for them, and perhaps more fortunately for everyone else, markets cannot simply be boiled down to equations and algorithms. As long as humans are involved in the process there’ll always be that irrational element.

Anybody who’s ever bought or sold something at some point has made an emotional decision. If they haven’t they’re either lying or not human. How does social sentiment affect the Bitcoin market? In a big way, it’s only one tool in your cryptocurrency toolbox.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.